How the United States fell behind the rest of the world in lithium - the White Gold of EVs.

Key Highlights

- The United States is experiencing a lithium supply shortage.

- According to Benchmark Mineral Intelligence, electric vehicle growth will account for more than 90% of lithium demand by 2030.

- However, lithium is found in our phones, computers, ceramics, lubricants, and medications, as well as being critical for solar and wind energy storage.

- Numerous domestic lithium projects are currently being developed in Nevada, North Carolina, California, and Arkansas, among other locations.

- Controlled Thermal Resources is building a lithium project at the Salton Sea in California.

Advertisement

The United States is experiencing a lithium supply shortage. Almost every major carmaker has announced a transition to electric vehicles. Tesla is on track to produce almost one million vehicles by 2021, and a number of upstart electric vehicle businesses, such as Rivian and Lucid, are ramping up production.

To power all of these EVs, we're going to need a lot more batteries.

According to Benchmark Mineral Intelligence, electric vehicle growth will account for more than 90% of lithium demand by 2030. However, lithium is found in our phones, computers, ceramics, lubricants, and medications, as well as being critical for solar and wind energy storage.

"It's similar to the blood in your body," Lithium Americas CEO Jon Evans explained. "It's the chemistry that enables lithium-ion batteries to function." It continues to be the common denominator in all battery technologies, even those being considered for next generation batteries. As such, it is a critical component.

This critical mineral used in rechargeable batteries has been dubbed "white gold," and the rush has begun.

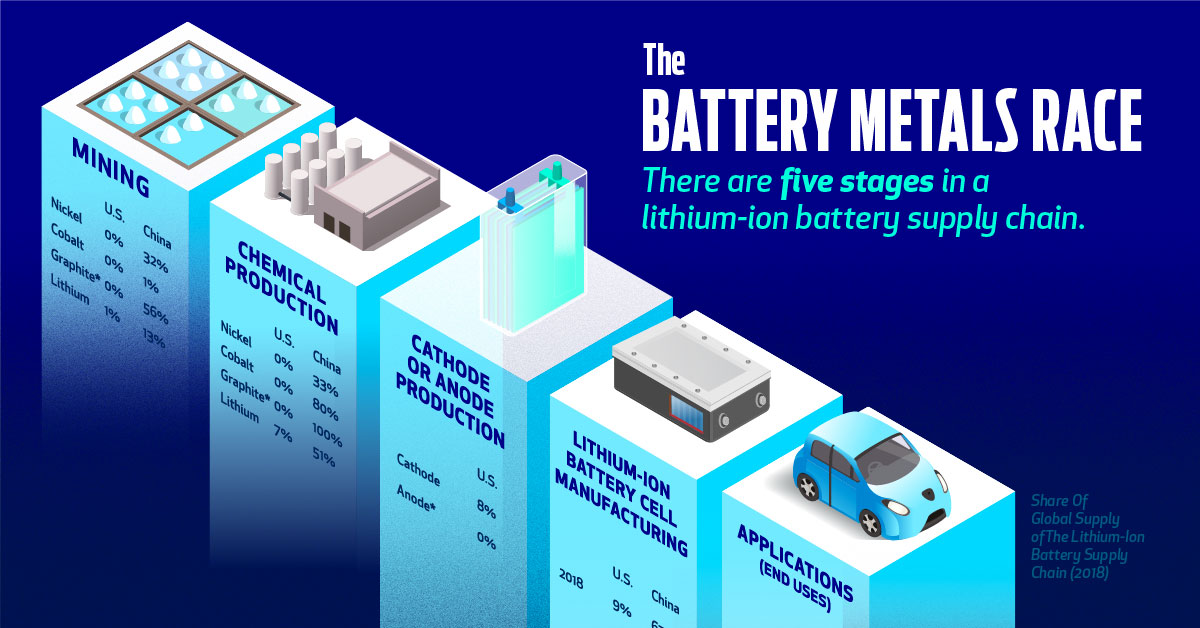

Lithium prices have risen 280 percent since January 2021, making securing a domestic supply the modern-day equivalent of oil security.However, the United States has fallen far behind, with only 1% of global lithium mined and processed in the country, according to the United States Geological Survey.

Australia, Chile, and China mine more than 80% of the world's raw lithium. And, according to the International Energy Agency, China has more than half of the world's lithium processing and refining capacity and has three-fourths of the world's lithium-ion battery megafactories.

Advertisement

However, until the 1990s, the United States was the world's largest producer of lithium.

"The lithium industry began in the United States and enjoyed a prosperous 50 years," said Erick Neuman, Swenson Technology's international business manager. We do have a great deal. The question is this: Can we provide what we require at a cost that is both economical and competitive? That is difficult.

Lithium is a common element. According to the USGS, the US holds nearly 8 million metric tonnes in reserve, placing it among the top five countries in the world.

However, the United States has only one operational lithium mine, Albemarle's Silver Peak in Nevada.

The administration released a blueprint in June for reviving domestic lithium production and refining, as well as battery manufacturing, and set a national EV sales target of 50% by 2030.

Numerous domestic lithium projects are currently being developed in Nevada, North Carolina, California, and Arkansas, among other locations.

Advertisement

A Lithium Americas employee processes lithium at the company's research and development facility in Reno, Nevada.

Controlled Thermal Resources is building a lithium project at the Salton Sea in California. The project will extract lithium from brine pumped up by the area's geothermal energy plants. The Salton Sea was formerly a popular tourist destination, but has since devolved into one of the biggest environmental and public health problems in modern history as a result of drier circumstances drying up a large portion of the lake. The state of California is attempting to revitalise the area by renaming it "Lithium Valley." The state intends to raise the funds necessary to do so.

GM announced a multimillion-dollar investment in Controlled Thermal Resources last summer, securing the first rights to purchase lithium produced domestically for its EVs.

Piedmont Lithium intends to reintroduce lithium mining to a region near Charlotte, North Carolina. Piedmont struck an agreement with Tesla in 2020 to supply the electric vehicle manufacturer with lithium produced from its reserves there, but the project has been delayed due to permitting issues.

Lithium Americas intends to develop an open-pit mine at Thacker Pass, Nevada, which is located beneath an extinct supervolcano about 200 miles north of Reno and contains one of the country's greatest lithium reserves. The location will be used for both mining and refining lithium and is currently in the final permitting phase.

However, no one wants a mine in their neighbourhood, and Thacker Pass and other proposals have been stymied by environmentalist litigation and resistance, permitting delays, and opposition from local Native American tribes.

Advertisement