Cobalt costs threaten EV affordability: Did the US relinquish resource control over oil?

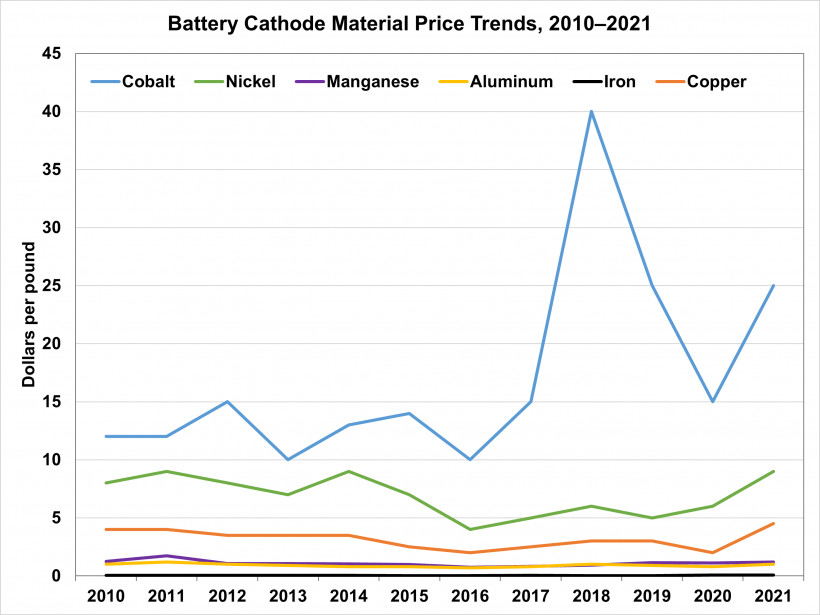

After spiking above $40 per pound in 2018, from a low of $10 to $15 for years, cobalt prices fell for a few years before rebounding back to about the same level—around $37 per pound as of last week.

It's the main reason why analysts currently predict that EV battery affordability will remain stagnant until 2024 or later.

Meanwhile, according to the New York Times, China's power struggle over cobalt has "rattled the clean-energy revolution," as U.S. interests that helped develop and oversee the cobalt market for decades, partly with strategic support from the US government, began selling their stakes to China just as the electric-vehicle boom was gaining traction.

![Child laborers in wolframite and casserite mine, Kailo, DRC, by Julien Harneis, 2007 [CC BY-SA 2.0]](https://images.hgmsites.net/hug/child-laborers-in-wolframite-and-casserite-mine-kailo-drc-by-julien-harneis-2007-cc-by-sa-2-0_100635527_h.jpg)

Child laborers in wolframite and casserite mine, Kailo, DRC, by Julien Harneis, 2007 [CC BY-SA 2.0]

The US government allowed that to happen as a diversion from the country's concern with energy resources, as reporters tracking the pattern have called it.

This selling of cobalt control to China occurred under the Trump administration—just before considerable political awareness of the matter began as a result of a USGS and Department of Commerce review done during that administration. The Biden administration has taken steps to increase the supply of raw materials for an American-made electric vehicle supply chain.

A decade ago, when Tesla planned its Nevada Gigafactory, it found it couldn’t acquire enough lithium, cobalt, graphite, and other crucial elements from U.S. suppliers.

Advertisement

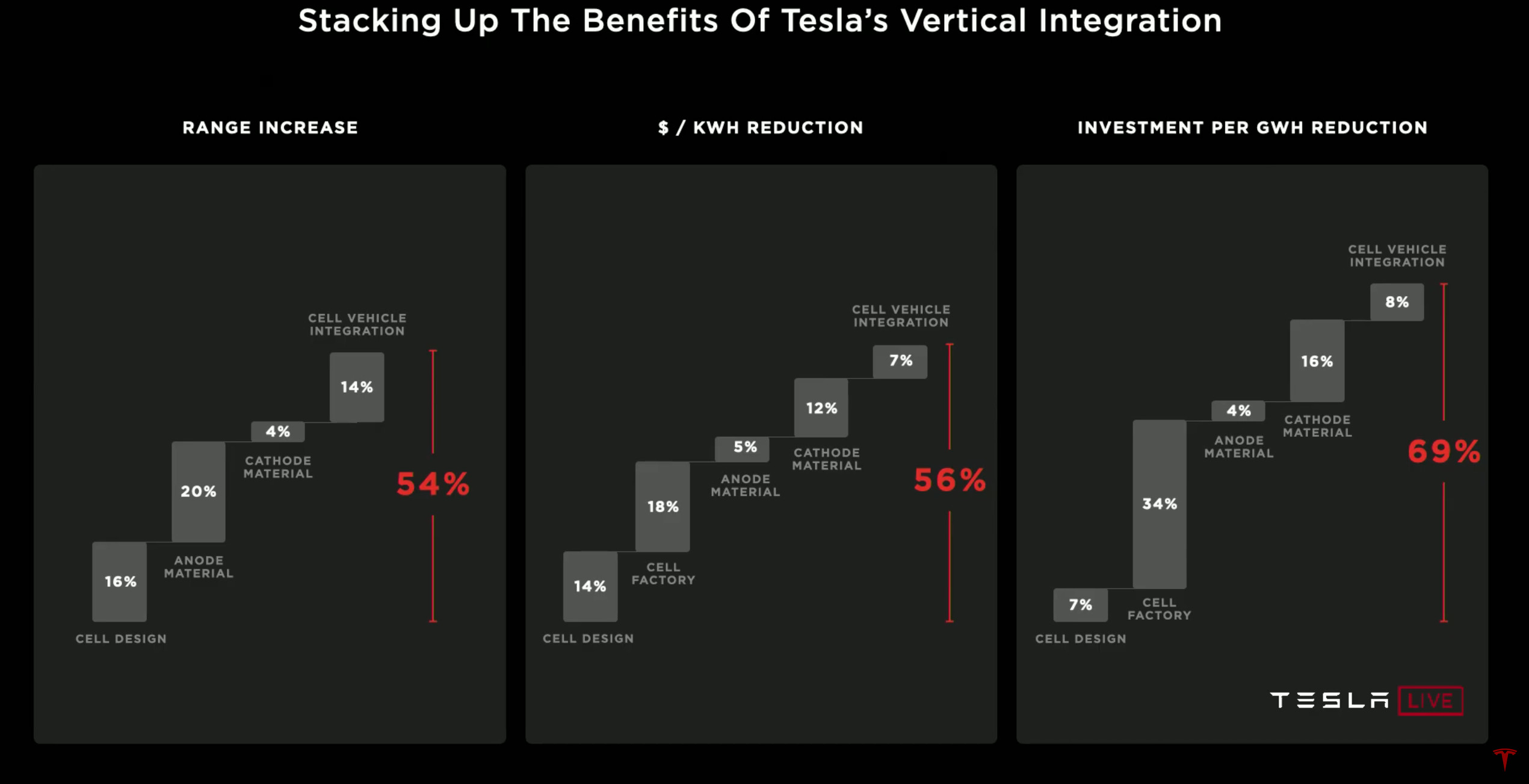

Tesla Battery Day vertical integration overview

That is why Tesla—and eventually Rivian—have shifted to lithium-iron phosphate (LFP) battery cells, which do not include cobalt or nickel but sacrifice driving range. Ironically, given China's market dominance, it is this cell chemistry that Chinese automakers have chosen to promote and mass-produce in their own market, while the West has grown increasingly reliant on resources controlled by Chinese resource suppliers.

The two most prevalent lithium-ion EV battery chemistries are nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA). Tesla has also been exploring ways to increase the amount of abundant manganese in its cells, potentially extending the life of its depleted cobalt supply. And sodium-ion batteries—which are likely further away—offer the possibility of avoiding lithium, another resource that the US did produce in the past.

Advertisement