Customers are informed by Rivian of IRS instructions on EV tax credits.

Customers of Rivian were informed through email of the Internal Revenue Service's (IRS) most current publication of instructions on the EV tax credits provided under the Inflation Reduction Act (IRA) of 2022.

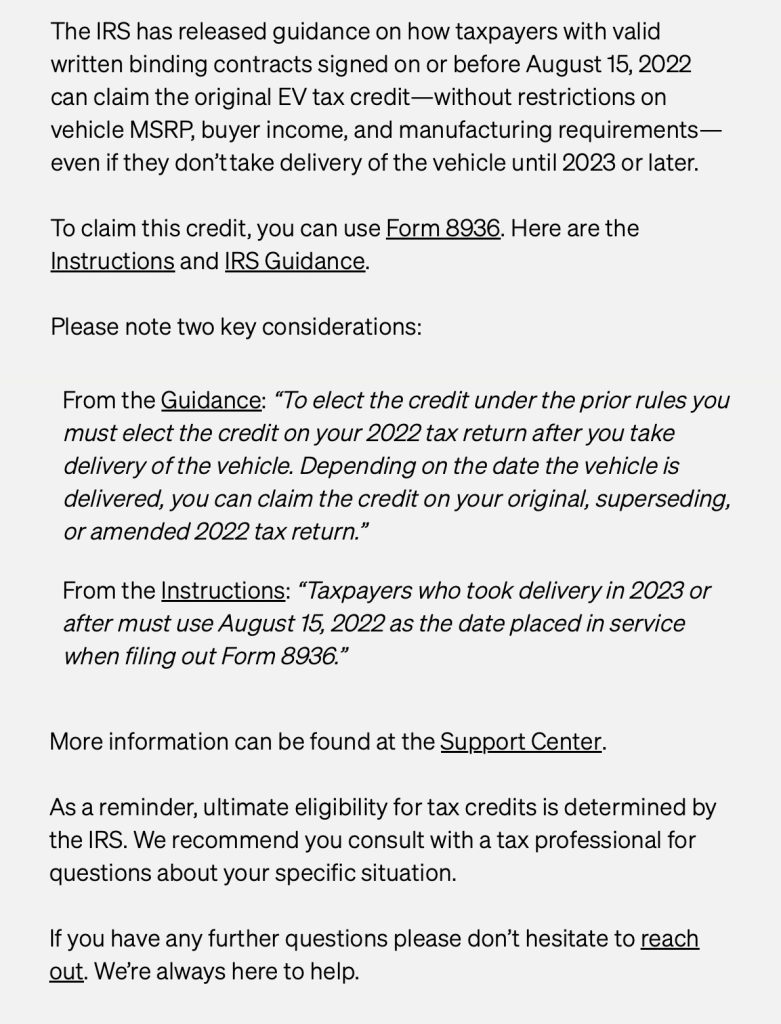

Rivian's emails to customers stated that the IRS has issued guidance on how taxpayers with legitimate written agreements signed on or before August 15, 2022 can claim the initial EV tax credit – without limitations on vehicle MSRP, buyer income, and manufacturing requirements – even if they don't take delivery of the vehicle until 2023 or later.

Advertisement

In regards to EV tax credits, Foley & Lardner LLP outlined the most recent IRS guidance. The advisory gave information on modifications to the Plug-In Electric Drive Vehicle Credit (EV Credits) part of the Inflation Reduction Act.

Credit: Prime

According to IRS-imposed rules, "final assembly" must take place in North America—including the United States, Canada, and Mexico—for vehicles placed in service after December 31, 2022 and before January 1, 2033, in order to be eligible for EV tax credits.

The additional requirements that an electric car must fulfil in order to qualify for the EV credit are listed below. These requirements were valid as of January 1, 2023.

- The taxpayer must be the one who uses the car for the first time.

- The car must be purchased for the taxpayer's own use or lease, not for resale.

- The manufacturer of the vehicle must be "qualified."

- For the purposes of Title II of the Clean Air Act, the vehicle must be regarded as a motor vehicle.

- A gross vehicle weight rating of less than 14,000 pounds must be present on the motor vehicle.

- The motor vehicle must be primarily powered by an electric motor that draws electricity from a battery with a minimum capacity of 7 kilowatt hours and the ability to be replenished by an external power source.

- The motor vehicle's final assembly must take place in North America, which is defined here as the United States, Canada, and Mexico.

- Any seller of a car to a taxpayer is required to provide the following information in a report to both the taxpayer and the Treasury Secretary:

- the taxpayer's name and tax identification number;

- the car's VIN number;

- the vehicle's battery capacity;

- confirmation that the taxpayer is the one who first uses the vehicle;

- The maximum credit under Section 30D of the Code that a taxpayer may claim in relation to the vehicle; and If a taxpayer chooses to transfer the credit to an eligible entity under Section 30D(g)(1) of the Code, any amount mentioned in Section 30D(g)(2)(C) of the Code that has been given to that taxpayer.