Mukesh Ambani: Will he beat Elon Musk with sodium-ion batteries?

Move to buy UK's Faradion kickstarting push for 'giga-factories' in India

HIGHLIGHTS

- Indian billionaire Mukesh Ambani is making forays into sodium-ion, a new battery technology.

- He hopes to make cheaper, safer batteries in ‘giga-factories’ similar to Tesla’s.

- Reliance purchased UK sodium-iron company Faradion in $135 million deal.

Indian industrialist Mukesh Ambani is on a roll. He’s promoting a new battery technology, known as sodium-ion batteries (SIBs). Currently, he is the world’s11th-richest man.

His stated goal: drive India, and the world, towards affordable green energy. In pushing for renewables, Ambani is unstoppable, having already acquired Faradion, a UK-based firm developing the cheaper-safer-than-lithium-ion technology, touted as the next disruptor.

In so doing, Ambani is set on a collission course of Elon Musk, currently the world's richest man behind the EV revolution. Musk's EV technology is mainly based on lithium ion batteries (LIBs), which is prone to fire, known as "thermal runaway".

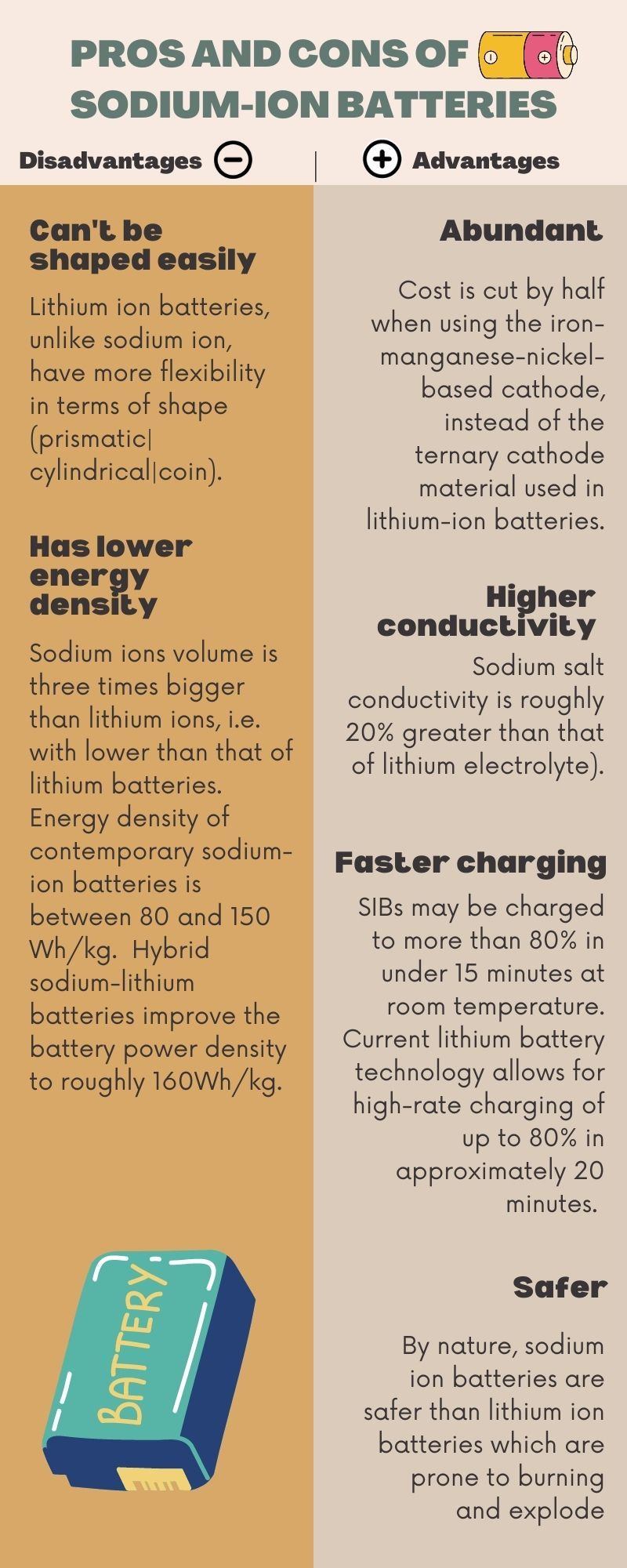

Compared to lithium-ion batteries, SIBs are inherently safer (due to its basic chemistry) and is emerging as a viable, cheaper alternative.

Advertisement

Will Ambani succeed? Here’s what we know so far:

How rich is Ambani?

Reliance Industries Ltd (RIL), a Fortune Global 500 company, is currently India's most valuable company by market value.

As of August 20, 2022, Forbes and Bloomberg Billionaires Index estimate Ambani's net worth at $92.7 billion. He is currently the second-richest person in Asia after Gautam Adani (net worth: $140.1 billion) and the 11th-richest in the world.

When did Reliance acquire Faradion?

In December 2021, Reliance New Energy Solar Ltd (RNESL), a wholly-owned subsidiary of RIL, bought 100% of UK-based sodium-ion battery technology Faradion Ltd, in a deal worth £100 million ($135 million).

Why is this move significant?

For one, it will help secure India’s energy storage requirements for its large renewable energy and fast-growing electric vehicle (EV) charging market.

Ambani has an eye on reducing the cost, in addition to safety and reliability of batteries. The cost of an EV battery is anywhere between 25% to 35% of the overall cost of an EV. Ambani aims to change that equation, and seeks to "improve battery economics", India’s Business Today quoted him as saying.

“Just as India has the world’s most affordable wireless broadband today, we will have the world’s most affordable Green Energy within this decade. And these solutions will then be exported to other countries, helping them contain carbon emissions,” he stated in a Reliance annual report early this month (August).

Why Ambani interested in sodium-ion batteries?

Reliance is already the biggest 5G standalone operator in India, with diverse interests in petrochemicals, natural gas, retail, media, energy and textiles. Reliance New Energy Solar Ltd (RNESL) has also invested in wind, solar and fuel cells. Reliance is also involved in the production and distribution of hydrogen.

The vision is for RNESL to create one of the most advanced and integrated new energy ecosystem and put India at the forefront of leading battery technologies, said Ambani.

There are at least 7 known companies currently leading sodium-ion batteries charge.

What are use cases for sodium-ion batteries?

Sodiun-ion batteries could power the 21st century: they are a promising technology for electric vehicles (EVs), the electricity “grid” — the interconnected network that delivers electricity and powers countries or continents.

Unlike lithium ion, sodium-ion batteries are inherently safe and are 2,000 times more abundant. They also operate well in colder climes, and are able to retainsgreater energy over time. The biggest downside of SIBs: they are energy dense than lithium-ion batteries (LIB).

By nature, sodium-ion batteries are up to 40% cheaper than lithium-ion batteries. But engineers are currently working to perfect the technology.

With sodium-ion batteries, will Ambani overtake Musk?

Energy storage is a fast-growing market. Innovations that come with high-stakes battery research are hitting the market faster than at any other time. Faradion touts its sodium-ion-based energy storage as “safe, sustainable, provides high energy density and is significantly cost competitive.”

Currently the numbers are in favour of lithium. According to Verified Market Research, the global sodium-ion battery market size, valued at $923 million in 2020, is projected to reach $2.5 billion by 2028, or 11.07% annual growth. In contrast, the global lithium-ion battery market size was $36.90 billion in 2020, projected to grow from $44.49 billion in 2021 to $193.13 billion by 2028, or a 23.3% annual growth during the eight-year period until 2028.

The availability and affordability of SIBs, could turn the energy storage industry on its head.

Advertisement

The main advantages of SIB: abundance, wide distribution, and low cost. That makes them the prime candidate for large-scale, grid-level, stationary energy storage solution, able to store power from wind, solar, wave and hydro power plants for use on demand.

Theoretically, LIBs and SIBs can co-exist, for different use cases. SIBs may eventually be used for electric vehicles, due to their safety credentials. Moreover, they could replace expensive and gas-fired “peaker plants”, a cost-effective way to store excess electricity from wind, solar or hydro-electric plants, using stationary "mega packs", thus addressing the intermittency of renewables.

What are Reliance’s plans for Faradion?

Reliance announced it will include Faradion’s technology at its proposed “giga-factory” as part of the Dhirubhai Ambani Green Energy Giga Complex project at Jamnagar in Gujarat, India.

The deal could accelerate Reliance’s plans to commercialise the technology via“giga scale” manufacturing in India, said Ambani.

Will sodium-ion be used in cars, too?

Ambani said he believes the move will help accelerate, and secure large-scale energy storage requirements for both EVs and the power sectors.