How did Gwynne Shotwell keep Tesla and SpaceX from going bankrupt?

Sunday, December 5, 2021 | Chimniii Desk

Key Highlights

- Between 2007 and 2009, the global economy was engulfed in a financial crisis that threatened the lives of millions of people and businesses.

- With this backdrop in mind, let's look at Elon Musk's time as CEO of both SpaceX and Tesla during the Great Recession.

- Gwynne Shotwell was able to sell a dozen launches and secure contracts before SpaceX had gotten anything into orbit, so SpaceX was better off.

- She was and continues to be well-connected with many high-ranking NASA and US government officials.

Advertisement

The global economy began to crack and shatter into a million pieces in 2008. Panic gripped stock exchanges all over the world. Employees lost their jobs when large corporations went bankrupt.

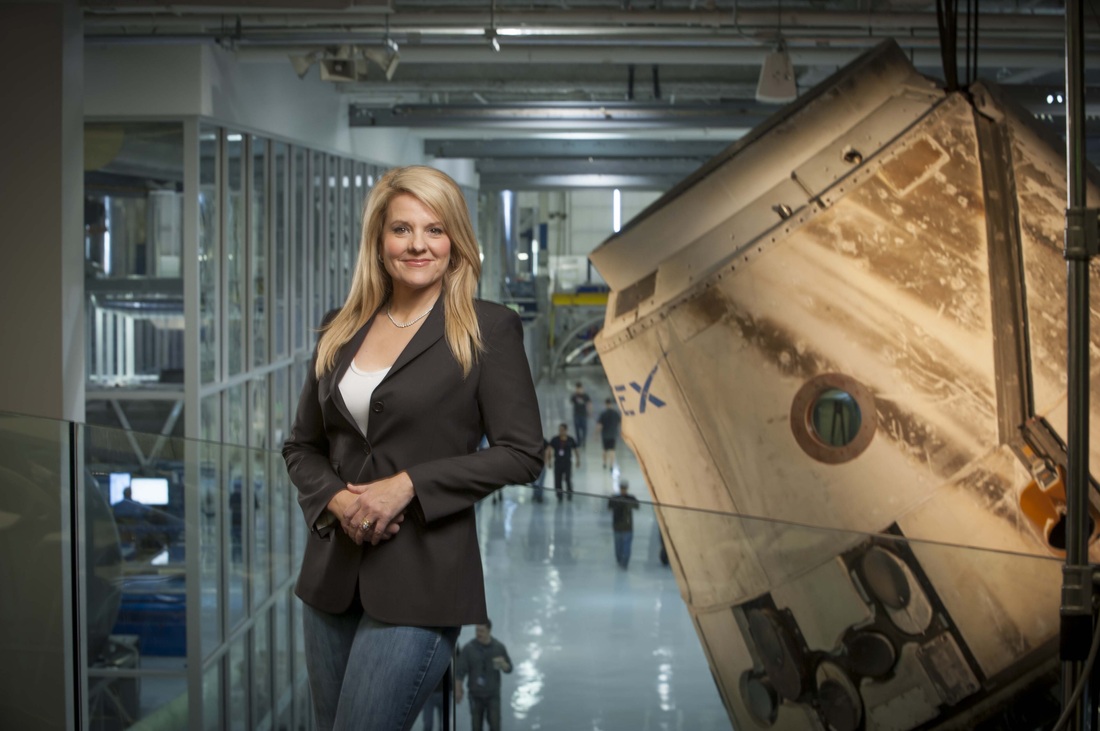

Until Gwynne Shotwell came to the rescue, Elon Musk's prized ventures, SpaceX and Tesla, were about to suffer the same fate as so many others. What exactly did she do? How did she pull it off? We'll find out in a matter of seconds.

Between 2007 and 2009, the global economy was engulfed in a financial crisis that threatened the lives of millions of people and businesses. You might have a reasonable understanding of what a financial crisis is and how it affects economies. However, for the purposes of this article's comprehension, we'll begin by briefly describing the impact of a financial crisis on economic recession.

When a country's gross domestic product (GDP) contracts or grows at a negative rate, it is said to be in an economic recession. By 2008, the world's developed and developing economies had experienced sustained periods of negative growth in the majority, if not all, of them.

What went wrong? The US Financial Crisis Inquiry Commission, which was established in response to the global recession beginning in the United States, identified four causes. They are, in order, as follows:

- Financial regulatory failures abound, including the Federal Reserve's inability to stem the tide of toxic mortgages.

- Corporate governance has broken down dramatically, with too many financial firms acting recklessly and taking on too much risk.

- The financial system is on a collision course with crisis due to an explosive mix of excessive borrowing and risk by households and Wall Street.

- Systemic breaches in accountability and ethics at all levels, as well as key policymakers who were ill-prepared for the crisis and lacked a complete understanding of the financial system they oversaw.

Advertisement

It's a jumble of complicated words, but once the clutter is removed, it's not too difficult to comprehend. The financial crisis of 2008 had deep roots, but it wasn't until September 2008 that the full extent of its consequences became apparent to the rest of the world.

The immediate trigger was a combination of speculative activity in financial markets, with a focus on real estate deals, particularly in the United States and Western Europe, and the availability of cheap credit.

'Speculative activity' refers to large-scale borrowing to fund property purchases in response to what appeared to be skyrocketing property prices. If you owned the property, you could sell it for a profit later as prices continued to rise.

Separately, however, the price of energy in the form of oil and gas began to rise. As a result of all of this, inflation rates have been rapidly rising. As the value of money fell due to inflation, millions of people who had taken out loans found themselves unable to repay them.

The banking sectors in the United States and the United Kingdom were unprepared for this, causing some to collapse and others to be rescued by their respective governments. Everything in a country's economy is interconnected, and it's also linked to the economies of other countries, so this deadly combination wipes out people's and corporations' savings, leading to financial ruin and bankruptcy.

With this backdrop in mind, let's look at Elon Musk's time as CEO of both SpaceX and Tesla during the Great Recession. Both businesses were involved in the development of experimental technologies and had yet to turn a profit.

Advertisement

Tesla, in particular, was on the verge of bankruptcy at a time when the electric car was seen as a novelty and even a joke by some. The Tesla Roadster debuted in 2006 with a revolutionary promise: drivers would be able to travel more than 300 kilometres on a single charge.

Most people were sceptical, but Elon Musk was adamant, and he planned to start mass production and sales in 2008. With his timing, he couldn't have been more unlucky. Musk's $200 million from the sale of PayPal was nearly depleted, and the economy had collapsed, so no new investors were willing to fund SpaceX or Tesla.

"I could either pick SpaceX or Tesla or split the money I had left between them," Musk explained. "It was a difficult decision." Maybe both of them would die if I split the money. If I gave the money to just one company, it had a better chance of surviving, but it would mean certain death for the other. I debated it for a long time."

One of the main reasons Tesla was able to stay afloat was because SpaceX was in better financial shape, which Musk was able to use to secure Tesla's finances.

Gwynne Shotwell was able to sell a dozen launches and secure contracts before SpaceX had gotten anything into orbit, so SpaceX was better off. She was and continues to be well-connected with many high-ranking NASA and US government officials.

These friendships and connections were formed during her time working for the government as part of a research firm. She was also a scientific expert in all things aerospace, so she knew what projects to sell and how to contract with NASA and other agencies.

- It took so much longer for SpaceX to complete a successful flight than it had anticipated. The setbacks were humiliating and detrimental to the company's bottom line. Shotwell did, however, sell a dozen flights to a mix of government and commercial customers before SpaceX launched its first Falcon 1 into orbit.

Advertisement

Her deal-making abilities extended to negotiating the big-ticket NASA contracts that kept SpaceX afloat during its lean years, including a $278 million contract in August 2006 to start work on vehicles that could ferry supplies to the International Space Station.

Tesla was almost certainly saved from bankruptcy by the proceeds from these flights, but the turning point came in December of 2008. Musk launched parallel campaigns to save his companies in December 2008.

He had heard that NASA was about to award a contract for resupply of the space station. SpaceX's fourth launch had put the company in a position to receive a portion of the money, which was estimated to be worth more than $1 billion.

Musk reached out to some Washington insiders and learned that SpaceX was a front-runner for the contract, so he did everything he could to reassure people that the company was up to the task of getting a capsule to the ISS.

In the case of Tesla, Musk had to go back to his existing investors and ask for another round of funding by Christmas Eve in order to avoid bankruptcy. Musk made a last-ditch effort to raise all of his personal funds and invest them in the company to give investors some sense of security.

He borrowed money from SpaceX, which NASA approved, and put it towards Tesla. Musk tried to sell some of his SolarCity stock on the secondary market.

He also seized $15 million from Dell's acquisition of Everdream, a data centre software start-up founded by Musk's cousins in which he had invested. Shotwell advised this course of action.

Advertisement

Musk gathered $20 million and asked Tesla's existing investors to match it, since no new investors had come forward. The investors agreed, and on December 3, 2008, Musk noticed a problem as they were finalising the paperwork for the funding round.

Except for one crucial page, VantagePoint Capital Partners, one of the investing firms, had signed all of the paperwork. VantagePoint's CEO informed him that they had declined due to the 'undervalued Tesla' investment round.

Musk avoided what he saw as a potential trap that would allow VantagePoint to take control of Tesla after the bankruptcy and remove Musk as CEO. After that, his dream would be essentially dead.

Musk has taken yet another huge risk. Tesla rebranded the funding as a debt round rather than an equity round, knowing that VantagePoint wouldn't be able to intervene in a debt deal due to legal constraints.

The tricky part of this strategy was that it put investors who wanted to help Tesla in a bind because venture capital firms aren't set up to do debt deals, and convincing them to change their normal rules of engagement for a company that could go bankrupt in a matter of days would be a tall order.

Musk bluffed because he was aware of this. He told the investors that he would borrow $40 million from SpaceX and fund the entire round himself. The deal was finalised on Christmas Eve, just hours before Tesla was set to go bankrupt.

Musk only had a few hundred thousand dollars left and would have been unable to pay his employees the next day. Musk eventually put in $12 million, with the rest coming from investment firms, saving Tesla.

None of this would have been possible without Gwynne Shotwell's intervention. Or do you have a different opinion?

Advertisement